Just How an Offshore Trust Can Enhance Your Financial Privacy and Safety

If you're looking to boost your financial privacy and protection, an offshore trust fund can be a sensible choice. By tactically placing your possessions outside local territories, you can secure on your own from potential lawful risks and analysis.

Comprehending Offshore Trusts: The Basics

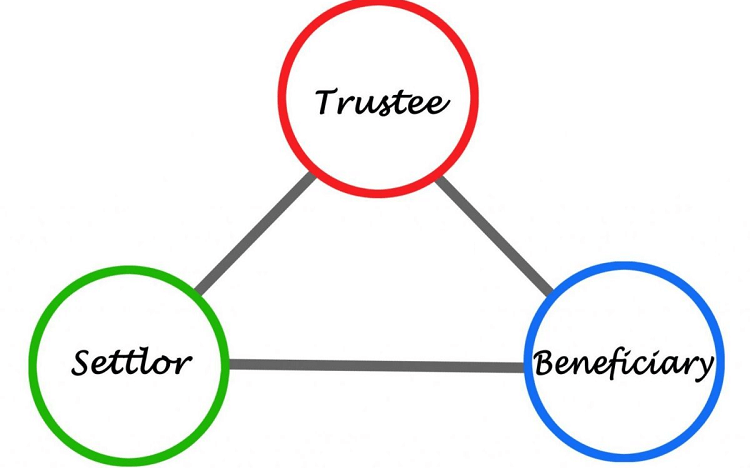

Offshore trust funds are effective financial devices that can offer you with boosted personal privacy and security for your assets. Basically, an offshore depend on is a legal plan where you transfer possession of your properties to a trustee located outside your home country. This trustee manages the assets in your place, allowing you to maintain control while appreciating the advantages of overseas financial systems.

You can use overseas depend protect your wealth from potential lawful issues, taxes, or political instability in your house nation. By positioning your properties in an overseas depend on, you produce a barrier between your wealth and any cases versus you, boosting your monetary safety and security.

Understanding the essentials of offshore trusts is important for any individual considering this method. You'll need to choose a respectable trustee and navigate the lawful demands of the jurisdiction where the count on is established, guaranteeing your possessions are safeguarded properly.

Secret Advantages of Offshore Trust Funds

2nd, offshore trusts offer diversity. You can purchase different currencies, markets, and possession classes, reducing threat and enhancing prospective returns.

Additionally, they can offer tax obligation benefits. Relying on the jurisdiction, you might enjoy tax benefits that improve your total financial technique.

Moreover, offshore depends on enable boosted control over your wide range. You can set specific terms for how and when your possessions are dispersed, guaranteeing your purposes are recognized.

Last but not least, they can aid with estate planning. An offshore depend on can streamline the transfer of wide range across generations, lessening prospective disputes. Overall, these vital advantages make overseas counts on an enticing option for economic safety.

Enhancing Financial Personal Privacy With Offshore Trust Funds

When you take into consideration offshore depends on, think of how they can considerably improve your financial privacy. These trusts supply durable possession protection techniques while guaranteeing confidentiality and anonymity in your financial transactions. By using them, you can secure your wide range from prospective threats and preserve your personal privacy in a significantly clear globe.

Possession Protection Strategies

Establishing an offshore count on can be a powerful method for improving monetary personal privacy and protection, especially if you're looking to safeguard your possessions from prospective lenders or legal insurance claims. By transferring your possessions into an overseas trust fund, you efficiently separate your personal wealth from your legal identity. Ultimately, overseas depends on can be a positive measure for anyone looking for to strengthen their monetary future.

Confidentiality and Anonymity

Offshore depends on not only supply robust property protection yet also play a significant role in enhancing your financial privacy. By positioning your assets in an overseas trust fund, you can effectively shield your economic information from prying eyes. In addition, the depend on structure can restrict access to your financial information, guaranteeing that only licensed people have insight right into your properties.

Protecting Possessions From Lawful Risks

When it involves safeguarding your riches, overseas trusts provide a durable lawful guard against potential threats. They supply a level of discretion and anonymity that can be vital in safeguarding your assets. By employing efficient property defense strategies, you can secure your financial future from legal challenges.

Legal Shield Advantages

While many individuals seek financial privacy, the legal shield benefits of offshore counts on can provide a vital layer of defense versus prospective legal threats. By placing your properties in an offshore trust, you can produce a barrier that makes it harder for financial institutions or litigants to reach your wide range. This technique helps you secure your possessions from lawsuits, separation settlements, and other legal cases. In addition, the territory where the count on is developed commonly has legislations that prefer asset defense, adding an additional layer of security. Essentially, an overseas depend on not just protects your monetary interests however also enhances your comfort, understanding your riches is much less prone to unexpected legal obstacles.

Privacy and Privacy

Just how can you assure your economic affairs remain confidential in today's progressively transparent world? An overseas count on can supply the discretion you look for. By putting your properties in this trust, you develop a legal obstacle in between your personal identity and your wide range, efficiently securing them from spying eyes. The depend on runs under the laws of a territory recognized for strict privacy policies, making it difficult for outsiders to access your information.

Furthermore, your participation as a trustee can continue to be surprise, guaranteeing your name isn't straight linked to the possessions. This anonymity can discourage potential lawful hazards, as people and entities may believe twice before targeting a person whose economic details are obscured. Protecting your personal privacy has actually never been much more critical, and an overseas trust fund is an effective tool.

Possession Protection Strategies

An overseas trust not only improves your monetary privacy but also serves as a durable property protection technique against legal dangers. By positioning your properties in a depend on situated in a territory with solid privacy legislations, you can secure them from financial institutions and lawsuits. In today's litigious setting, using an offshore count on can be a smart relocation to protect your financial future and maintain control over your properties.

Political and Financial Security: A Factor To Consider

When taking into consideration overseas counts on, political and economic stability in the selected territory plays a crucial duty in protecting your properties. You wish to guarantee that the go to this site atmosphere where your trust is developed continues to be safe and dependable. Political chaos or financial instability can jeopardize your investments and compromise your economic privacy.

Seek territories with constant governance, a strong lawful framework, and a background of financial durability. These factors add to the trust fund's long life and your peace of mind.

In addition, you need to analyze the country's regulatory environment. Favorable laws can enhance your depend on's performance, while limiting regulations may prevent its performance.

Inevitably, by prioritizing political and financial security, you're not just protecting your possessions; you're likewise paving the means for long-term monetary safety. Your careful selection will help ensure that your trust continues to be a powerful tool in your monetary strategy, allowing you to achieve your goals with self-confidence.

Picking the Right Territory for Your Offshore Trust Fund

Which factors should direct your option of jurisdiction for an offshore depend on? Look for territories with strong property defense regulations to secure your trust fund from potential creditors.

You need to also consider the regulative setting. A trustworthy jurisdiction with clear laws can enhance your trust's trustworthiness and security. Accessibility to specialist solutions is another necessary aspect; ensure that the jurisdiction has knowledgeable legal and economists that can help you efficiently.

Last but not least, evaluate the privacy legislations. You desire a place that prioritizes your privacy and safeguards your details. By considering these aspects, you'll be better geared up to select a jurisdiction that lines up with your monetary objectives and boosts your safety and security and personal privacy.

Steps to Establishing an Offshore Trust

Selecting the right territory is just the beginning of your trip to developing an overseas count on. Next, speak with a qualified attorney that concentrates on offshore depends on. They'll direct you through the lawful requirements and warranty compliance with both neighborhood and international regulations.

Afterwards, identify the possessions you wish to put in the trust. This can include cash, property, or financial click this investments - Offshore Trusts. Once you've established this, choose a trustee, a person you trust or a professional trust fund firm, to handle your count on according to your wishes

After that, draft the count on action, describing the terms and conditions. This document will information how the possessions are managed and dispersed. Fund the count on by moving your chosen assets. Keep records of these deals for openness and future recommendation. With these actions, you'll get on your means to appreciating enhanced financial personal privacy and safety and security via your overseas count on.

Frequently Asked Concerns

Can I Establish an Offshore Depend On Remotely?

Yes, you can establish an overseas trust from another location. Many jurisdictions permit online applications and assessments. Just guarantee you research trusted firms and comprehend the lawful demands to make the procedure smooth and protect.

What Are the Tax Obligation Ramifications of Offshore Trusts?

Offshore trusts can have various tax obligation implications depending on your residency and the count on's structure. You could encounter tax obligations on revenue created, but proper planning might assist reduce liabilities and take full advantage of benefits. Constantly speak with a tax consultant.

Exactly How Are Offshore Depends On Controlled Globally?

Can I Adjustment the Trustee of My Offshore Count On?

Yes, check here you can change the trustee of your offshore trust fund, however it typically requires following specific procedures laid out in the trust fund file. Make certain you understand any type of lawful ramifications prior to making that choice.

What Happens if I Transfer To Another Nation?

If you transfer to another country, your overseas trust fund's tax obligation implications could transform. You'll need to evaluate neighborhood laws and perhaps speak with a specialist to assure conformity and optimize your financial method properly.